Payroll tip calculator

Download your free printable timesheet templates here. There are special tax requirements for tips because they are often paid in cash.

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Input the tip amount hourly rate number of hours pay period and other details into our Tip Tax Calculator to see what your paycheck should be.

. She earns 213 an hour works 30 hours a week and reports 250 in tips in a given week. The key on your calculator makes certain calculations very simple. Quarterly Contribution Return and Report of Wages Continuation DE 9C Employer of Household Workers Annual Payroll Tax Return DE 3HW.

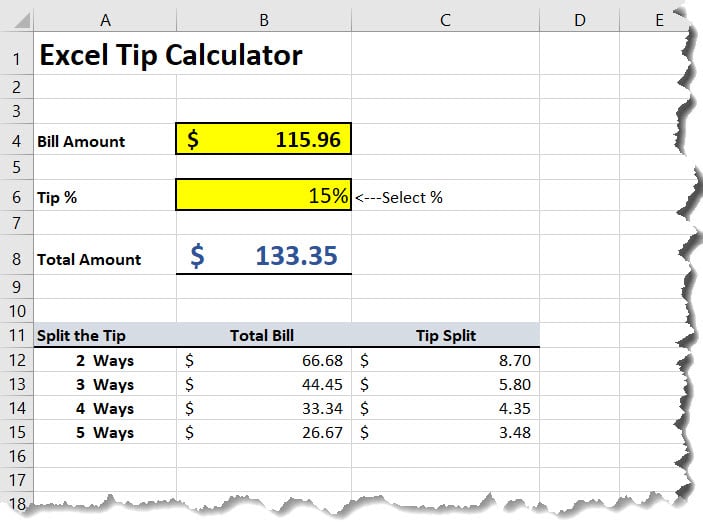

The calculator is a simple Excel spreadsheet that calculates for you based on the total amount pay group and number of pay periods. The Board Foot Calculator is a simple online tool for calculating board feet without a complicated formula. Suppose you want to calculate a tip amount and you want to find 15 of the total bill of 7532.

Process your payroll with tip-top accuracy whether its monthly bi-monthly or weekly. Export bank files and generate payroll reports. Calculate average tips per hour.

The installment loan calculator exactly as you see it above is 100 free for you to use. Calculate and print employee paychecks in all 50 states as well as Puerto Rico Guam Virgin Islands and American Samoa. You simply enter the length width and thickness of your boards and how many of them you have to easily determine the total number of board feet.

The following tax returns wage reports and payroll tax deposit coupons are no longer available in paper. Using a payroll ledger template is a quick and easy way to keep track of crucial payroll information in one convenient place. A FICA tip credit calculator can help you estimate how much of a tax credit you may receive.

Click the Customize button above to learn more. Consider working with a trusted and reputable payroll provider to help you. Get 247 customer support help when you place a homework help service order with us.

Sarah works at a restaurant. If you want to customize the colors size and more to better fit your site then pricing starts at just 2999 for a one time purchase. Direct deposit printed check or pay card options Choose the best fit for paying your team including options that are free for you like Toast Pay Cards and our new self-serve check.

Paycheck Tip Tax Calculator. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. If you receive tips in your paycheck this calculator will help you estimate the withholdings every pay period.

TaxCaster tax calculator Tax Bracket calculator W-4 withholding calculator ItsDeductible donation tracker Self-employed expense estimator Back Back Back Support. Clockify Pro Tip. The excavation cost calculator exactly as you see it above is 100 free for you to use.

Payroll taxes filed Toast will remit and file your federal state and local payroll taxes. Please check with your agency HR office for information on eligibility. Quarterly Contribution Return and Report of Wages DE 9.

Form 4562 Depreciation and Amortization. When calculating board feet you are determining what the total volume of wood you have is. The kilograms to pounds calculator exactly as you see it above is 100 free for you to use.

If you have your calculator available you will enter the buttons 15 x 7532. SDL Calculator Calculate your CPF online with this free tool. If you own a restaurant a bar or any other small business where employees earn tips from customers you have the added responsibility of withholding taxes from your employees paycheck based on the tips they receive.

Some people are naturals at time management and some just arent. Export bank files and generate payroll reports. Form 4137 Tax on Unreported Tip Income.

The FICA tax came about as part of the Federal Insurance Contributions Act FICA and essentially represents the payroll tax that is levied by the United States Federal government on both the employer and employee. After switching to LEDs or when replacing a faulty LED lamp in some cases the LED light will start flickering We will explain temperature settings alarm sounds door not closing water filter changes not cooling issues not making ice no power strange sounds leveling ice makers water dispensers This refrigerator has the icemaker bin on the top of the freezer door If the LED. By using a template you can also avoid having to build your own payroll ledger system from scratch.

Our free FICA tax calculator will also split out the proportion of FICA tax that you pay that represents Medicare and the portion. Time. Selecting Pay Basis in PeopleAdmin This quick guide pdf shows you how to select appropriate basis on position descriptions and hiring proposals in.

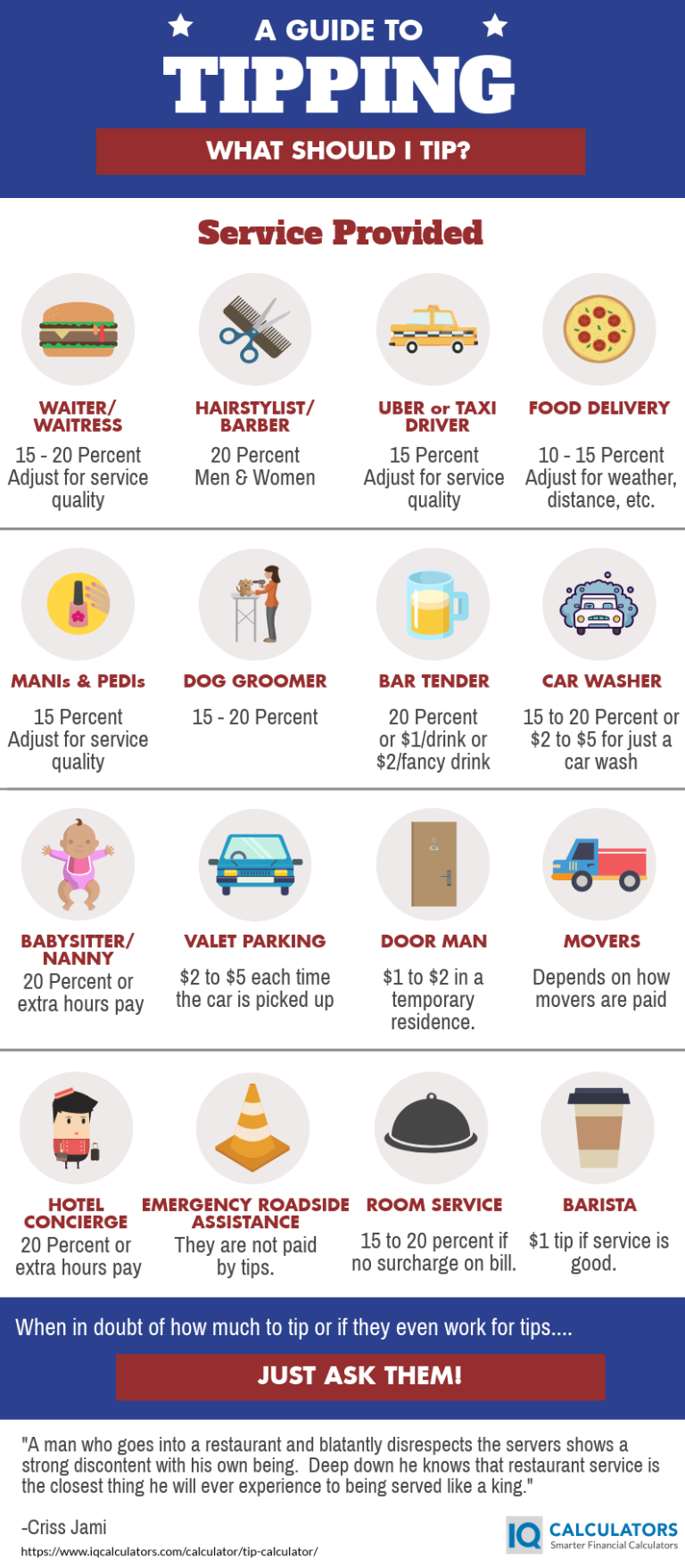

View your companys leave calendar at a glance. Hiring employees is a big step for small business owners. This calculator is useful for waiters waitresses servers bartenders restaurant ownersmanagers and other gratuity or tip-based careers where earned tips are reported as wages.

You should get the result of 11298 which represents a tip of 1130. Including hiring payroll processing and tip pooling. And if you rely more on templates it just so happens that we made a super-comprehensive collection of daily weekly and monthly timesheet templates.

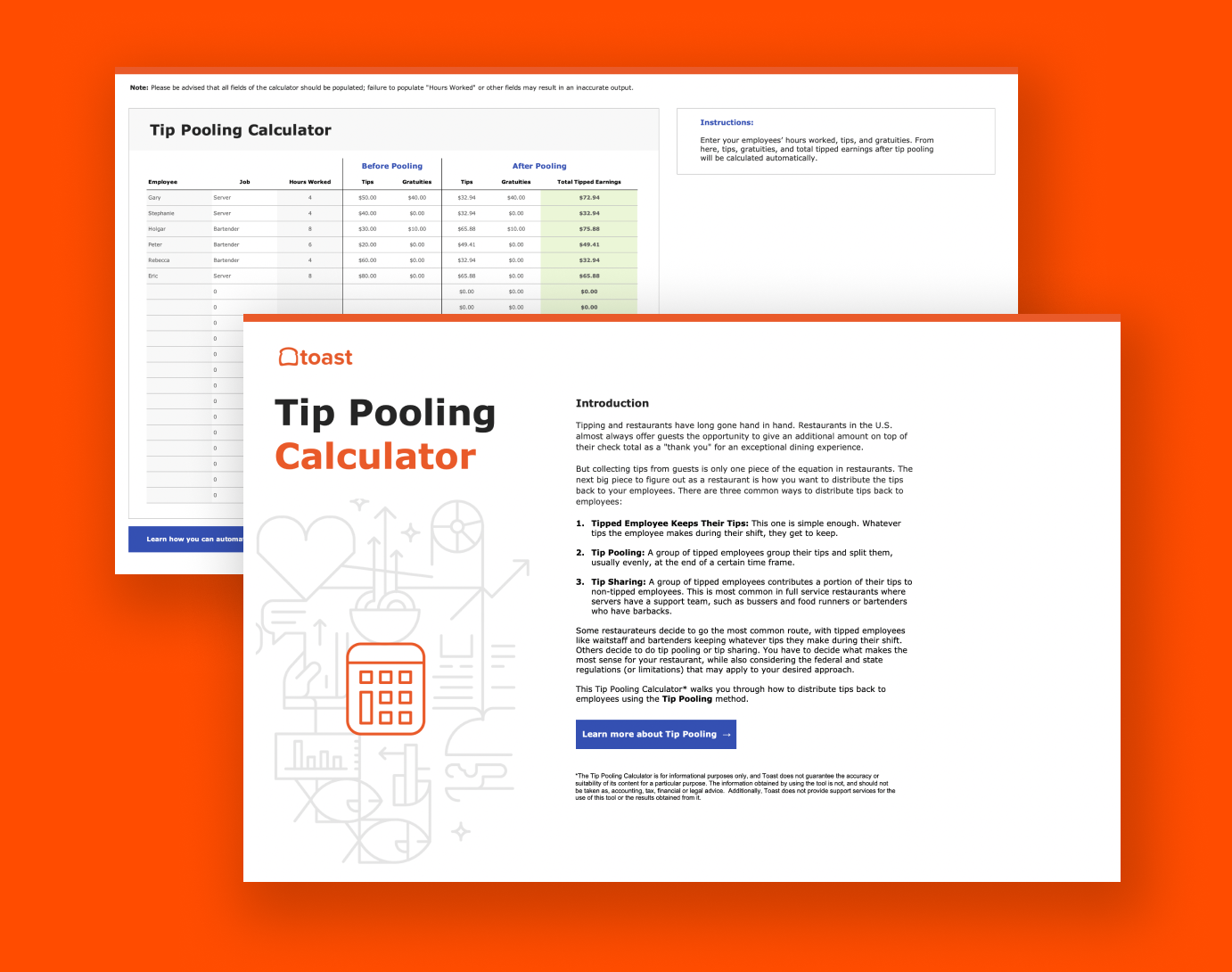

If your business pools tips the entire tip amount is. If you want to customize the colors size and more to better fit your site then pricing starts at just 2999 for a one time purchase. Payroll records should be kept 3 years including paystubs payroll advance records etc.

Run payroll for hourly salaried and tipped employees. Employment tax documentation includes Form W-4 W-2s records detailing fringe benefits tip allocation sick pay etc. Employer of Household Workers Quarterly Report of Wages and.

Based on your industry requirements and tiering. A payroll ledger is one solution to ensure valuable data isnt lost as you scale. Set different leave grades for selected individuals.

If you want to customize the colors size and more to better fit your site then pricing starts at just 2999 for a one time purchase. Form 4684 Casualties and Theft. Heres an example of calculating FICA tip credit.

Employees Important News effective July 1 2022 Fiscal Year 2023 Fiscal Year 2023 COLAIncrement changes for eligible employees. Simple payroll processing in all 50 states Skip the manual uploads and post payroll in three easy steps. Calculator to determine the number of S Pass and Work Permit holders you can hire by calculating your Dependency Ratio Ceiling DRC or quota.

IRS resources Paycheck calculator Form W2 or 1099. PrimePay Payroll. Click the Customize button above to learn more.

Process your payroll with tip-top accuracy whether its monthly bi-monthly or weekly. To calculate average tips divide the total tip amount by the number of hours worked in the pay period. Learn how to do payroll for small business with Intuits expert resources and strategies.

Click the Customize button above to learn more.

How To Calculate Payroll Taxes Methods Examples More

Tip Tax Calculator Primepay

Tip Pooling Calculator Toast Pos

Tip Calculator Template In Excel Download Template Excelbuddy Com

![]()

Tip Tax Calculator Payroll For Tipped Employees Onpay

Nvai7b73uqmw5m

Payroll Calculator For Excel Excel Tutorials Excel Templates Payroll

How To Calculate A Tip Without A Calculator

Tip Calculator Free Tip Calculator App

How To Calculate Wages 14 Steps With Pictures Wikihow

Tip Pooling Calculator Toast Pos

Free Tip Tax Calculator

Payroll Calculator Excel Template 2022 Paycheck Spreadsheet

Tip Tax Calculator Payroll For Tipped Employees Onpay

Payroll Calculator With Pay Stubs For Excel

How To Calculate Payroll For Hourly Employees Sling

Tip Calculator How To Calculate A Tip Wise